Day 6 - The Conversion of Place — Data, Value and the Truman Brewery Data Centre

Introduction — Context and Proceedural Setting

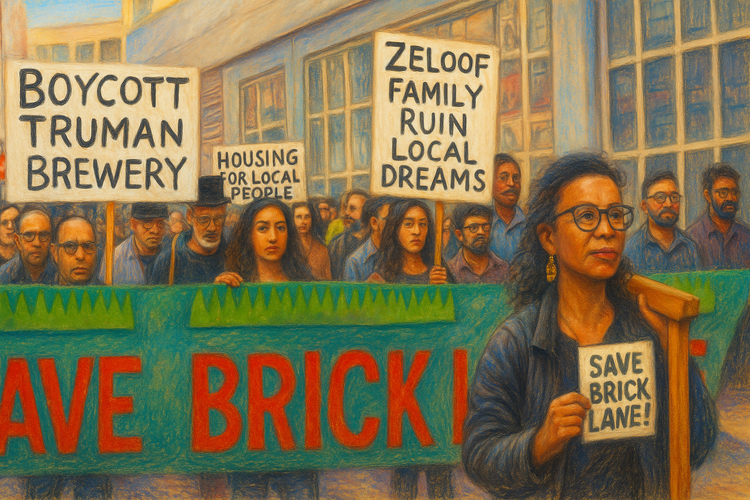

The redevelopment of the Old Truman Brewery on Brick Lane has become one of the most closely watched planning cases in London. The appellant, Truman Estates Ltd (Jersey)—the offshore freeholder of the brewery estate controlled through the Zeloof family’s business interests—seeks consent for a major mixed-use scheme centred on a new data-centre complex (Block A) and associated commercial and retail units. The London Borough of Tower Hamlets refused the earlier application in 2023 following strong local opposition led by the Save Brick Lane campaign, citing harm to heritage and community use.

That refusal was appealed, and the proposal is now being examined through a public inquiry, which the Secretary of State has formally called in for ministerial determination. The case therefore sits at the intersection of local heritage policy and national economic strategy. The developer is represented by professional planning and heritage consultants, while the council, community organisations, and independent experts appear as respondents.

At issue is not only the physical form of redevelopment but the economic logic underpinning it: whether planning consent should function as a lever for land-value re-rating and offshore extraction, or as an instrument of public stewardship. What follows analyses the evidence heard at the inquiry to understand how a data-centre proposal became the test-case for London’s new planning economy.

The Missing Question — Townscape and Infrastructure

On Day 6 (afternoon) of the public inquiry into the Truman Brewery redevelopment, proceedings opened with Ailish Killilea of The Townscape Consultancy (see Oral Testimony, Day 6). She described the scheme as “heritage- and design-led regeneration,” explaining that she had been instructed to assess townscape and heritage impacts and prepare the HTVIA (see Written Evidence, CDM.08). She maintained that the proposal would “enhance the townscape … adding an authentic and highly interesting layer of character and strengthening the sense of place.”

Under cross-examination by Richard Wald KC and Hugh Flanagan, Killilea defended the height and bulk of Block A: any “momentary occlusion” of Christ Church Spitalfields or the brewery chimney would be “momentary along Buxton Street … brief for the pedestrian moving west.” Once the envelope was accepted as visually tolerable, its function could be claimed as technically inevitable.

That argument was advanced by Celeste McGinley MRICS of Knight Frank Global Data Centres, who followed Killilea on the stand. Her evidence shifted the discussion from heritage justification to infrastructural necessity, asserting that Block A’s “location, form and security are matters of necessity not preference” (see Written Evidence, CDM.27). Between them, the two witnesses traced the path by which design becomes destiny—the moment where architecture turns into asset.

From Location to Necessity

McGinley introduced herself as “a Senior Surveyor within Knight Frank’s Global Data Centres team, advising owners, occupiers and investors on the planning, development and disposal of data-centre assets” (see Written Evidence, CDM.09). Her central claim was geographic inevitability: Block A was “the only current opportunity of its kind within the City–Docklands corridor,” serving “London’s established low-latency cluster.” Relocation or reduction, she said, would be “technically and commercially unviable.”

When Wald KC asked whether any occupier had been identified, McGinley replied that “demand for capacity of this kind is continuous and structural rather than linked to any single operator.” “Need,” in this formulation, became an attribute of the market itself. Planning language adjusted: “employment” turned to “capacity,” “public benefit” to “resilience.” A discretionary proposal re-emerged as technical imperative—a private venture recast as public necessity.

Scale, Enclosure and the Politics of Design

Having secured necessity, McGinley described form as its consequence. “Floor-to-ceiling heights and overall mass are determined by the technical requirements of modern colocation facilities … These are not discretionary design decisions but the physical dimensions of the technology itself.” When asked if a smaller facility could serve the purpose, she answered that “below approximately three megawatts IT load a scheme ceases to be commercially and technically viable.”

Security language completed the shift. “Controlled access, perimeter integrity and limited public frontage are essential features rather than design choices … any active frontage or glazing at ground level would introduce unacceptable security risks and potential vectors for breach.” Opacity became virtue; enclosure, civic responsibility. Architecture dissolved into infrastructure—and infrastructure into ideology.

The New Land-Value Machine

Beneath the engineering lay the motive of revaluation. Data-centre leases, long and credit-rated, generate bond-like income; once consented, such assets are traded as infrastructure. Knight Frank’s dual role—advisor and marketer—shows the loop clearly: planning → development → disposal. Permission itself becomes the pricing event. The brewery’s industrial ground, once valued for production, is now prized for yield stability. Planning functions as the state’s instrument for authorising capital’s permanence (see Written Evidence, CDM.09).

The Temporality of Necessity — Technology and Obsolescence

The paradox of “necessity” lies in its timing. McGinley’s figures—5 266 m² NIA, 5–5.5 MVA draw, twelve staff—describe a facility already trailing its industry. Edge computing and modular networks decentralise processing; “performance is governed by network design, not geography; the latency premium that once favoured inner-city locations has dissolved” (see Internal Technical Source, ConserveConnect Internal Technical Review 2025, unpublished). Block A thus exemplifies a legacy typology—“a large, inward-facing, high-energy warehouse justified by arguments that no longer hold technical or policy validity.”

Yet redundancy is precisely its function. Once permitted, the financial effect—re-rating the land—is immediate. The building becomes a device for temporal arbitrage, converting short technological cycles into long-term asset value. Necessity is a provisional fiction bridging innovation and extraction—a machine for converting obsolescence into yield.

From Theory to Evidence — The Data Centre as Financial Instrument

The logic of assetization is enacted through the inquiry itself. Planning procedure is the mechanism that turns speculative land into certified infrastructure. Once “critical national infrastructure” is granted as a label, the building is re-coded from venture to asset class. Consent transforms uncertainty into duration. Public process becomes the ritual by which private risk acquires the appearance of inevitability.

This threshold—where theory becomes demonstration—was visible on Day 6. Through the exchange of witnesses, the abstractions of finance assumed physical form. Expert testimony supplied the moral vocabulary—need, security, resilience—that naturalised investment as duty. From this point, the inquiry record itself became a ledger of value, its language inscribing yield into the urban fabric (see Oral Testimony, Day 6).

Day 6 (Afternoon): Townscape and Infrastructure in Evidence

Killilea normalised the envelope; McGinley declared it inevitable. Their dialogue enacted the conversion of design into asset. When Wald KC and Flanagan challenged function and transparency, McGinley reiterated the economic thresholds and security lexicon embedded in her proofs (see Oral Testimony, Day 6). The Inspector’s interventions—rulings that ownership and finance were “outside scope”—sealed the perimeter. Form could be discussed; capital could not. The inquiry’s discipline was its revelation: the most material questions were procedurally inadmissible.

Ownership and Uplift

Land-registry filings confirm that the freehold title to the Truman Brewery complex is vested in Truman Estates Ltd, registered in Jersey — a jurisdiction favoured for its absence of UK corporation and capital-gains tax and for its permissive trust laws (per HM Land Registry, Title No. 86608, accessed 24 October 2025). The company’s beneficial interests are declared through Line Trust Corporation Ltd (Gibraltar), acting as trustee for a private settlement controlled by Douglas Ryan (per Register of Overseas Entities entry OE023908, accessed 24 October 2025). Day-to-day operations — lettings, events, and short leases — are handled by the UK-registered Old Truman Brewery Ltd, whose Person of Significant Control is Jason Zeloof (ownership of shares 75 % or more).

This layered structure separates cash-flow generation in London from asset ownership offshore, enabling profits to accumulate beyond the reach of domestic taxation or disclosure. Within this framework, the UK operating company appears as a tenant of the Jersey freeholder, transferring income upward through management fees, inter-company loans, or dividends. The effect is a stable architecture of extraction: the ground remains local, but the yield is expatriated.

Historic financial data reviewed in a ConserveConnect Investigative Briefing (2025) — “Truman Brewery Ownership and Financial Structure” — indicate distributions of approximately £225 million between 2016 and 2017, coinciding with earlier phases of uplift produced by new consents on adjoining plots. (This analysis is internal and not part of the official inquiry record.) Each planning permission functions as a valuation event:

consent → re-rating → refinancing → distribution.

In practice, once consent is granted the estate’s book value rises, allowing lenders to extend new credit lines against the re-rated asset. Those loans finance shareholder distributions or intra-group transfers to the Jersey parent. No sale need occur; profit is realised through refinancing alone. Meanwhile, the borough receives only marginal gains in rateable value yet bears the external costs — energy demand, infrastructure strain, and enforcement — of an expanding private estate. Liabilities remain public; benefits flow offshore.

Planning permission therefore becomes a financial instrument — a derivative of policy that can be priced, leveraged, and traded long before construction. The planning process, conceived as a brake on speculation, now serves as its certification system: the official moment when political consent is transformed into financial security. In this configuration, planning operates not merely as regulation but as the city’s conversion interface — the junction where the tangible substance of land meets the abstractions of global capital.

Ownership Cross-Check (24 October 2025)

According to the Register of Overseas Entities (Companies House entry OE023908), Truman Estates Ltd has been registered since 7 February 2023, address Level 1, IFC1, Esplanade, St Helier, Jersey JE2 3BX. Registrable beneficial owners are Douglas Ryan (“has significant influence or control,” notified 22 August 2019) and Line Trust Corporation Ltd (Gibraltar) (trustee; “ownership of shares – more than 25 % as trustees of a trust”; notified 29 December 2016). The ROE notes the annual statement marked ‘overdue’ (next due 20 February 2025). The Jersey register lists Truman Estates Ltd (no. 109887) as active. For operational context, the UK company The Old Truman Brewery Ltd (04166396) lists Mr Jason Zeloof as PSC (ownership of shares 75 % or more). These public-record entries corroborate the stable offshore ownership and onshore operation described above.

Why the ROE Matters

As of October 2025, the ROE entry for Truman Estates Ltd (Jersey) remains marked “annual statement overdue.” Under the Economic Crime (Transparency and Enforcement) Act 2022, this status does not affect ownership or the validity of planning permissions, but it restricts the company’s ability to register any sale, lease, or charge at HM Land Registry until its filing is brought up to date. Such delays are common among offshore property-holding entities and may arise from administrative oversight, coordination with parallel jurisdictional filings, or refinancing arrangements.

The persistence of overdue filings nonetheless highlights a gap between planning regulation, which proceeds irrespective of ownership transparency, and financial oversight, which depends on timely disclosure. The ROE therefore offers a useful indicator of how major urban landholdings operate across overlapping regulatory regimes — visible to the planning system but opaque to the public record.

ROE Compliance and Secretary of State Call-In

The continuing “overdue” status of Truman Estates Ltd coincides with the project’s escalation from a local planning process to a case formally called in by the Secretary of State. Although the public hearing continues—witnesses are still being examined and the Inspector will report recommendations—the final decision now rests with the Minister, reflecting the scheme’s national policy and economic significance.

During this interim period, ownership and financing structures are typically held static. Updating the ROE while the project’s regulatory and valuation status remains unsettled would risk producing information that requires amendment once the Minister issues a final determination.

Under the Economic Crime (Transparency and Enforcement) Act 2022, an overdue ROE does not affect ownership or participation in the hearing, but it prevents the registration of any new lease, charge, or disposal at HM Land Registry. For offshore property vehicles such as Truman Estates Ltd, the pragmatic course is to await the Secretary of State’s decision before aligning disclosures with the post-decision financing structure.

This illustrates how planning, legality, and transparency operate on divergent timelines: the inquiry continues to gather evidence, the Secretary of State deliberates on policy, and financial disclosure follows only once the direction of value is fixed.

The Boundary of Inquiry

Whenever cross-examination approached these financial realities, the Inspector re-established the procedural perimeter. Questions of ownership, refinancing, or profit extraction were ruled “outside the scope of this inquiry.” Later, when Hugh Flanagan linked grid load and low employment yield to borough sustainability policy, the Inspector added that “energy supply and distribution fall under separate regulatory regimes.”

Within that cordon, capital became unassailable. The hearing could dissect façades and photomontages, but not the corporate structures that produced them. The line drawn as procedural neutrality in fact demarcated the limit of accountability. The inquiry’s transcript records an exhaustive debate on heritage, massing, and mitigation—yet omits the single fact that determines all others: who benefits.

By excluding financial motive, the planning system maintains its claim to impartiality while safeguarding the interests of investment. Form is interrogated; ownership is presumed. The very boundaries of admissibility become the city’s defensive walls for capital. Within them, planning performs its quietest function: to naturalise private extraction as public reason.

What This Reveals About London’s Development Logic

The Truman Brewery inquiry distils the grammar of contemporary urban development. What appears as a dispute about design or heritage is in fact a demonstration of how London now reproduces itself as financial infrastructure.

The process follows a consistent sequence: designation of obsolete industrial land as “strategic infrastructure”; planning consent converting risk into security; refinancing and offshore distribution; reinvestment of extracted capital into the next consent cycle. Each iteration converts physical London into a rolling portfolio.

Across the city the same pattern repeats. Heritage and industrial sites are re-badged as “innovation hubs” or “infrastructure hubs.” Low-employment typologies—data centres, logistics depots, life-science labs—are justified by appeals to resilience. Ownership migrates offshore; inquiry procedure restricts debate to design and policy. The result is a city composed of assets rather than buildings, calibrated to the rhythms of investment rather than habitation.

This is not failure but the success of a new system. Planning, once mediation, has become capital’s primary instrument of legitimation. Heritage provides continuity, infrastructure provides morality, and expert testimony provides reason. Together they supply the civic façade behind which extraction proceeds as policy.

Conclusion — The Conversion of Place

Over six days of testimony, the vocabulary of planning mutated. Necessity displaced choice; security displaced design; yield displaced use. The inquiry revealed not simply a proposal but a transformation in the purpose of planning itself.

Block A is more than a building: it is a certificate of value, converting speculative ambition into durable yield. Its purpose is not to connect but to contain; its promise is permanence of income. The building type’s obsolescence heightens its usefulness—an asset whose profitability derives from consent, not operation.

For the surrounding community, the loss is twofold: materially, the substitution of a public realm of exchange with a sealed volume of data custody; linguistically, the replacement of regeneration’s civic language with the technocratic idiom of resilience. “Development” no longer means making but securitising.

Brick Lane’s struggle is paradigmatic. It marks the point where planning ceases to allocate land for living and instead allocates certainty for capital. The conversion of place is complete when the authority that once restrained speculation now guarantees its return.

The Theatre of Expertise

The inquiry performs neutrality to a script. On its surface are drawings and photomontages; beneath it, procedures that translate speculation into compliance. Around it, residents and small traders have fought to defend their street, yet the structure of the process ensures their voices carry no weight.

Expertise itself has become infrastructure. Proofs, design codes, and cross-examinations act like the conduits within the data centre: they move value invisibly, converting private motive into public reason. The repetition of procedural phrases—“within policy,” “in accordance with guidance,” “outside scope”—forms the insulation through which finance speaks as governance.

The moral authority of the process depends on omission. By excluding ownership, profit, and displacement, the inquiry preserves its image of neutrality. In truth, neutrality is the mechanism of capture. It allows extraction to proceed as administration, the privatisation of value to appear as civic order.

When the transcripts are bound and archived, what remains is a record of reason without motive—a meticulous account of everything except the forces that compelled it. Reading between those lines reveals the architecture of the modern city: the translation of speculative intent into public necessity. This, finally, is the stage on which London performs itself.

Index of Sources

Oral Testimony

- Ailish Killilea — Heritage & Townscape Lead, The Townscape Consultancy; Day 6 afternoon session (verified recordings).

- Celeste McGinley MRICS — Knight Frank Global Data Centres; Day 6 afternoon session.

- Richard Wald KC — Counsel for Tower Hamlets; cross-examination of Killilea and McGinley.

- Hugh Flanagan — Junior Counsel, Arthur Taylor Chambers; cross-examination of McGinley.

- The Inspector — Procedural rulings on scope and regulatory boundaries.

Written Evidence

- Proof of Evidence of Ailish Killilea, CDM.08.

- Proof of Evidence of Celeste McGinley, CDM.09.

- Rebuttal Proof of Celeste McGinley, CDM.27.

- HM Land Registry Title No. 86608 (91 Brick Lane E1 6QL), summary and title plan, accessed 24 October 2025.

- Register of Overseas Entities entry OE023908 (Truman Estates Ltd), Companies House, accessed 24 October 2025.

- Companies House record for The Old Truman Brewery Ltd (04166396), accessed 24 October 2025.

Internal Investigative Report

- ConserveConnect Investigative Briefing (2025): “Truman Brewery Ownership and Financial Structure.” Internal research document produced by ConserveConnect, London. Not part of the official inquiry record; referenced for contextual analysis only.

Internal Technical Source

- ConserveConnect Internal Technical Review (2025): “How the Plan Aligns with Current Data-Centre Trends.” Unpublished report held by ConserveConnect, London. Available to inquiry participants and cited with permission.

Technical & Policy Sources

- The London Plan (2021) — Policies D.ES2, D.CF1, SI 2–3.

- Tower Hamlets Local Plan (2021) — Policy D.SG4 and related energy and employment clauses.

Academic References

- Brett Christophers, Our Lives in Their Portfolios (Verso, 2023).

- Manuel B. Aalbers, The Financialization of Housing (Routledge, 2016).

- McKinsey & Company, Tech Trends 2025: Cloud and Edge as a Continuum.

- Boston Consulting Group, Digital Infrastructure Outlook 2024.

Editorial Note

This report is a fair and accurate account of open proceedings at the Truman Brewery Public Inquiry and is protected by qualified privilege under Schedule 1 of the Defamation Act 1996. Commentary and interpretation reflect the author’s independent analysis in accordance with NUJ and IPSO standards for accuracy, fairness, and responsible journalism.

This article represents analysis and opinion prepared by ConserveConnect, based on publicly available information, verified inquiry transcripts, and internal research. All company and ownership details are drawn from official public registers and filings current as of 2025.

References to ConserveConnect’s internal technical and investigative reports are included for contextual understanding only; these materials are unpublished and not part of the official inquiry record.

No statement within this publication should be interpreted as alleging unlawful conduct by any individual or organisation. The analysis is offered in good faith as a contribution to public discussion on planning, heritage, and the financialisation of urban development.