Part II — The Financialisation of London

Mortgage Urbanism and the Brownfield Myth

The financialisation of urban space is not only a monetary transformation but a spatial one. When capital can no longer reproduce itself through industry, it turns to the built environment as its refuge. The Belgian sociologist Manuel Aalbers, whose work Subprime Cities (2012) traced the roots of the 2008 crash, calls this process the secondary circuit of capital: the channel through which surplus money seeks storage in land and housing. In the twentieth century, this meant suburban expansion; in the twenty-first, it has meant the vertical re-colonisation of inner cities.

In Britain, the ideological vehicle for this shift is the discourse of brownfield renewal. The Greater London Authority’s 2025 consultation, Towards a New London Plan, frames redevelopment as environmental virtue—a cleansing of urban “waste” through investment. Yet, as Aalbers and the Marxist geographer David Harvey both emphasise, such spaces are never neutral voids; they are already socialised, shaped by histories of labour, community, and use. To recast them as derelict is to prepare them for liquidation.

Under financialisation, “brownfield” becomes a floating signifier for any plot that can be leveraged. Designations such as Opportunity Area, Housing Zone, or maturing site operate as instruments of liquidity. Harvey’s notion of the spatial fix—capital’s need to resolve crises of over-accumulation by territorial expansion—finds its metropolitan expression here. Each redevelopment releases a wave of credit, absorbs surplus finance, and momentarily stabilises profit rates, until the next site must be cleared.

Across London, from Nine Elms to the Old Kent Road, the pattern is legible: land converted to liquidity, liquidity to debt, debt to absence. Displacement is not an unintended side-effect but a necessary stage in this cycle, the mechanism through which capital creates space for its own reinvestment. The new London Plan institutionalises that logic. By combining an enormous housing target with “streamlined” viability appraisal, it promises exactly what finance demands—predictable throughput. What disappears is the city as a living organism; what remains is the city as balance-sheet.

The New Governance of Viability

The American planner Samuel Stein, in Capital City (2019), describes this emergent regime as the real-estate state: one in which public authority functions primarily to preserve asset values. Its constitutional principle is viability.

Originally, viability analysis was a planning safeguard, ensuring that affordable housing or infrastructure requirements would not render development impossible. In the age of finance, the logic has inverted: now public policy must prove its viability to developers. The burden of justification has shifted from private profit to public purpose.

The London Plan crystallises this reversal. Every environmental, social, or heritage standard is now subject to the test of profitability. Aalbers’s definition of financialisation as “the spread of Wall Street logic into every corner of social life” acquires spatial precision here. The risk calculus of securitised mortgages becomes the risk calculus of planning. A conservation area, a community hall, a social-rent quota—each is treated as a threat to yield, a potential obstruction to “delivery.”

For Raquel Rolnik, the Brazilian urbanist and former UN rapporteur, this transformation marks the conversion of rights into revenues. In her book Urban Warfare (2019) she shows how the right to housing has been displaced by the right of investors to extract income from land. Municipalities, starved of grants and pushed into debt, act as junior partners in this extraction—selling or leasing public land and measuring success through gross development value.

The Mayor’s planning authority, once imagined as a democratic counterweight to speculative power, now functions as its broker. The 2025 Plan’s ambition to “align borough plans” into a single growth engine effectively re-centralises risk management at the metropolitan scale while privatising the gains. This is not deregulation but re-regulation in the service of liquidity—the process Aalbers identified when he observed that “creating markets for liquid capital reflects the politics of liquidity.” London’s politics has become precisely that: the governance of liquidity through planning law.

From Council Estates to Collateral Assets

The modern history of British housing can be read as a gradual conversion of social infrastructure into financial collateral. Rolnik’s global account of privatisation describes “the progressive dismantling of social rights to open rent channels for capital,” and London stands as her most vivid case.

Beginning with the Right-to-Buy programme of the 1980s and extending through stock transfers and private-finance-initiative (PFI) schemes, the city’s public housing stock became a pipeline of mortgage-ready assets. Once alienated from municipal ownership, these dwellings could be securitised; their land re-valued; their tenants recast as consumers. By the 2000s, “estate regeneration” itself had become a financial product. Public land offered low-risk sites, planning gain substituted for subsidy, and developers pre-sold entire blocks to institutional investors seeking stable yields.

The political economist Brett Christophers, in Our Lives in Their Portfolios (2023), documents how such assets are now controlled by pension funds and asset-management firms whose legal duty is to maximise returns, not provide housing. The 2025 Plan’s rhetoric of “partnership” conceals this arrangement. Boroughs have ceased to be planning authorities in any substantive sense; they operate as co-issuers of debt backed by land once held in common. The boundary between public housing and private finance has collapsed, leaving a hybrid terrain of quasi-public profit.

Heritage as Carbon Instrument

In the latest Plan, London’s architectural past is re-coded as a variable in the climate ledger. Section 4.4 invites citizens to consider heritage through its “potential contribution to net zero.” What seems a gesture toward sustainability conceals a new form of valuation. When preservation is justified by carbon offset, it becomes an environmental derivative—its worth calculated through exchange value rather than cultural meaning.

Harvey’s phrase “the annihilation of space by time” captures this dynamic. The endurance of a building—its physical persistence—is converted into a temporal credit, tradable against future emissions. A nineteenth-century warehouse is no longer valued for its narrative of labour or migration but for the tonne of carbon saved by its retrofit.

In this fusion of ecology and finance, retrofits become securitisable through “green bonds,” while energy-performance ratings feed directly into asset valuations. The civic argument for conservation—the claim that memory and identity are collective goods—disappears. Heritage survives only insofar as it performs financially.

Brownfield Sovereignty: Opportunity Areas and the New Financial Geography

London’s forty-seven Opportunity Areas are often presented as spatial strategy; in practice they are territorial balance-sheets. Each bundles land, planning consent and infrastructure promises into a predictable investment environment—a sovereign guarantee of yield.

Aalbers reminds us that under financialisation, states do not withdraw but re-embed finance in space. The GLA’s Opportunity Area Planning Frameworks exemplify this re-embedding. They provide what investors call regulatory certainty: a managed risk environment in which capital can circulate without local obstruction.

From Stratford City to Nine Elms, the choreography repeats: public infrastructure financed through debt, repaid by land-value uplift; social housing diluted through “tenure mix”; small traders displaced from the districts they sustained. The 2025 Plan’s pledge to “streamline and update” these areas effectively converts them from planning instruments into perpetual vehicles for value extraction. As Christophers notes, the state’s spatial function has shifted from redistribution to “guaranteeing the circulation of capital in place.” The map of Opportunity Areas has become the cartography of London’s financial geography.

The Moral Geography of Extraction

Every city embodies a moral economy as well as a spatial one—a sense of what may be bought and what must be protected. Financialisation redraws that moral map. When housing, heritage and open space are treated as investment classes, moral boundaries are replaced by yield curves.

Harvey’s concept of accumulation by dispossession describes this precisely: the systematic expropriation of common assets, the erosion of planning rights, the displacement of communities. Rolnik’s term urban warfare extends the metaphor, for the battlefield is everyday life itself—rent, debt, eviction, the erasure of memory.

In London this warfare is bureaucratic. Its instruments are spreadsheets and consultations, not tanks and barricades. Its casualties are those who can no longer afford to live in the spaces their histories built. Towards a New London Plan becomes the treaty that formalises defeat: a metropolis optimised for extraction.

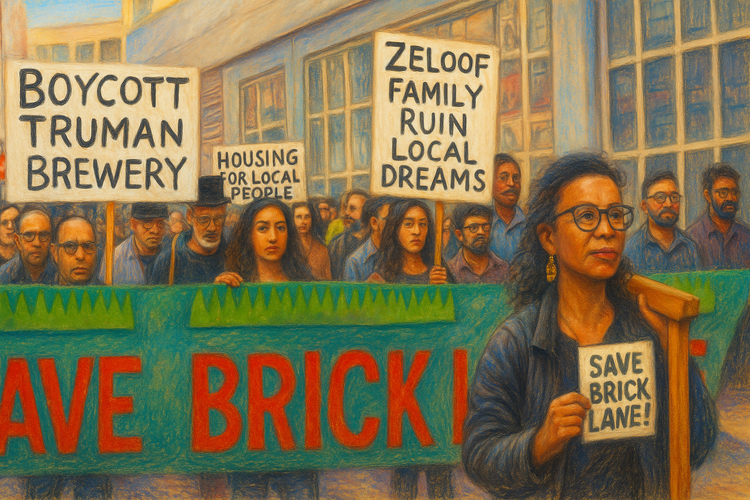

Yet cities possess moral memory. Against the abstraction of finance stand traditions of mutual aid, tenancy activism, civic trusts and campaigns such as Save Brick Lane. Their resistance is not only local but epistemic. It asserts that value is not yield, that conservation is not stagnation, and that the right to the city cannot be collateralised.

Coda

Financialisation did not emerge ex nihilo; it is the culmination of decades of policy that blurred the boundary between planning and profit. The 2025 London Plan simply codifies this history into law. To challenge it requires, in Lewis Mumford’s enduring phrase, that we “restore the organic relation between place and purpose.” Only by re-establishing that relation can London again become a commonwealth rather than a marketplace.

Index

Aalbers, Manuel B. — Economic sociologist; theorised the financialisation of housing and the secondary circuit of capital; defines financialisation as “the spread of Wall Street logic into every corner of social life.”

Accumulation by Dispossession — David Harvey’s concept describing capital’s expropriation of public or common assets as a condition of continued growth.

Asset Management Firms — Institutional investors controlling housing and infrastructure assets; prioritise yield over social use.

Brownfield Redevelopment — Redevelopment framed as environmental renewal; mechanism for capital reinvestment and displacement.

Christophers, Brett — Political economist; author of Our Lives in Their Portfolios; documents how pension funds and asset managers dominate housing markets.

Council Estates — Public housing converted into mortgage-ready assets through Right-to-Buy, stock transfers and PFI schemes.

David Harvey — Marxist geographer; coined secondary circuit of capital, spatial fix, and accumulation by dispossession; central theorist of urbanisation under capitalism.

Displacement — Structural feature of financialised redevelopment, clearing space for renewed investment.

Financialisation — Integration of housing, land and planning into global circuits of capital accumulation.

Green Bonds — Financial instruments linking retrofit projects and carbon savings to portfolio performance.

Heritage as Carbon Instrument — Re-coding of conservation through carbon offset metrics; transforms preservation into a tradable derivative.

Housing Zones / Opportunity Areas — GLA spatial frameworks packaging land and consent into investment products.

Liquidity Politics — Aalbers’s idea that states actively create markets for liquid capital; governance of liquidity through planning law.

Moral Economy of the City — Redrawing of moral boundaries under financialisation; replacement of civic value by yield curves.

Nine Elms / Old Kent Road — Exemplary sites of financialised regeneration and displacement.

Raquel Rolnik — Brazilian urbanist; author of Urban Warfare; theorises the empire of finance and the conversion of rights into revenues.

Samuel Stein — Urban planner; author of Capital City; defines the real-estate state and critiques viability-led governance.

Spatial Fix — Harvey’s term for capital’s use of space to resolve crises of over-accumulation.

Thomas Wainwright — Economic geographer; analyses how U.S. mortgage logic was adapted for U.K. markets.

Towards a New London Plan (2025) — GLA consultation institutionalising the financialisation of planning and housing.

Viability Testing — Planning mechanism assessing profitability; emblem of policy capture by financial logic.

Urban Warfare — Rolnik’s metaphor for everyday struggle under financialised housing regimes.

The next article, London for Sale: An Open Objection to the New London Plan (2025), moves from analysis to action—where London’s civic movements confront the Plan itself.