Part I — The Empire of Finance: How Property Became London’s Primary Market

Series Introduction

The Asset State: London, Planning and the Financialisation of Space

Over the past half-century, London has undergone a transformation more profound than any since the industrial age. The city that once embodied Britain’s manufacturing and municipal modernity has been refashioned as the headquarters of a global asset economy. The change can be read in the skyline and on the balance sheet alike: factories displaced by finance, neighbourhoods converted into portfolios, and the civic art of planning re-engineered into the logistical management of investment pipelines.

The immediate occasion for this enquiry is Towards a New London Plan (May 2025), the consultation document intended to guide the capital’s development over the coming decade. Beneath its language of delivery, good growth and streamlining lies a decisive shift in the philosophy of urban government. What was once a debate over land use and social purpose has become a technocratic exercise in liquidity management. The Plan does not inaugurate this order; it consolidates it, codifying the financialisation of space as public policy. It is therefore a document of culmination, not commencement—a mirror in which the longer evolution of the British state into what might be called the asset state becomes visible.

That evolution can be traced across three dimensions, each explored in one of the essays that follow.

- Part I — The Empire of Finance: How Property Became London’s Primary Market reconstructs the long turn from production to property, showing how the search for profit in a de-industrialising economy redirected capital into land and housing, transforming them into the main circuits of accumulation.

- Part II — The Financialisation of London examines how this logic captured governance itself: how the once-public machinery of planning was recalibrated around viability tests, opportunity areas and carbon accounting, instruments through which value can be extracted and securitised.

- Part III — London for Sale: An Open Objection to the New London Plan (2025) moves from analysis to political contestation, gathering the voices of residents, campaigners and scholars who confront the consequences of a city designed for investors rather than inhabitants.

Taken together, these essays offer both anatomy and indictment. They chart the emergence of a metropolis in which land functions as leverage and citizenship as collateral. Against this background, the task is not simply to critique planning policy but to recover an older conception of the city—as a shared realm of production, memory and democratic life, rather than as the favoured asset class of global finance.

The Empire of Finance: How Property Became London’s Primary Market

The City as Derivative

In the half-century since the collapse of Britain’s industrial base, London has become the archetype of the post-industrial metropolis. What was once a manufacturing and mercantile capital has been re-engineered into a hub of asset management, private equity and speculative development. The Greater London Authority’s Towards a New London Plan (May 2025) appears, on its surface, to offer a spatial blueprint for the next decade. Yet the document’s language—of delivery, viability and streamlining—reveals a deeper function: the consolidation of finance as the city’s organising principle. London no longer treats land as the ground of social life but as the substrate of leverage, the platform on which financial instruments are built.

The American geographer David Harvey, writing in the 1970s, described the urban built environment as capitalism’s “secondary circuit of capital”: a domain that absorbs surplus profits when manufacturing falters. Over the intervening decades this secondary circuit has supplanted the primary one. Housing, offices and infrastructure now constitute the chief media through which capital circulates and accumulates. As the economic geographer Brett Christophers observes, cities such as London have been reorganised to function as the operating systems of asset-manager capitalism—a marketplace where the city itself is administered as a portfolio of income-producing assets. London has not merely hosted global capital; it has been reconstituted in its image, becoming, in effect, its own derivative

From Production to Property

The process through which capital migrated from production to property is what the Belgian sociologist Manuel Aalbers calls the financialisation of housing. In his work on mortgage markets he traces how surplus capital, unable to find sufficient returns in manufacturing, was channelled into the built environment. Through innovations such as mortgage-backed securities and credit-scoring systems, the fixity of land was transformed into liquidity—“creating liquidity out of spatial fixity,” as Aalbers puts it. Homes ceased to be primarily social goods; they became vehicles for the extraction of rent and interest.

This transformation was actively engineered by the state. Regulatory frameworks that once separated public housing from private investment were dismantled. Governments, seeking to stimulate growth without public expenditure, invited finance into the housing system. In Britain, successive administrations re-wrote planning and mortgage law to attract global capital, dissolving boundaries between public and private, domestic and foreign. The result was the emergence of a new financial-urban complex in which property served as both collateral and commodity.

The Logic of Liquidity

Harvey argued that capitalism is driven by an imperative to “annihilate space by time”—to compress the slow materiality of production into the instantaneity of exchange. Securitisation accomplished precisely that. A mortgage, once a slow contract of decades, was sliced into tradable bundles of risk and sold on secondary markets. Neighbourhoods became asset classes; city districts, exchangeable derivatives. Urban policy followed suit. Instead of allocating land according to social need, planning authorities were tasked with maintaining the liquidity of property markets.

By the early twenty-first century, housing finance had become the world’s largest marketplace. The crash of 2008 did not expose the separation of finance and housing but their complete fusion. The real-estate/financial complex, as Aalbers names it, had become the structural core of contemporary capitalism. London, Europe’s command node within that system, emerged from the crisis not chastened but emboldened: austerity and quantitative easing together inflated asset prices and deepened dependence on rentier income.

The British Variant

Britain’s embrace of this regime has its own genealogy. The deregulation of Building Societies in the 1980s and the 1988 Housing Act opened the way for property to function as a speculative asset. The financial geographer Thomas Wainwright has shown how the logics of American securitisation were “re-invented and re-regulated to fit the City of London’s markets.” Under successive governments, council estates and brownfield land were converted into instruments of investment. By the 2000s the Greater London Authority’s Opportunity Area framework had become a city-wide mechanism for channelling capital: planning re-designed as pipeline management. “Development viability” replaced social purpose as the dominant metric of policy.

In this British variant, the public sector became the guarantor of private accumulation. Local authorities, deprived of central funding, came to rely on land sales and developer contributions to finance basic services. Planning consent itself became a commodity—negotiated, traded and priced.

The Real-Estate State

The American urbanist Samuel Stein has termed this configuration the real-estate state: a condition in which governments act principally to preserve the value of assets. In Britain, the long decade of austerity intensified the dependence. Planning departments, stripped of revenue, were forced to court the very developers they were meant to regulate. Policy shifted from regulating profitability to protecting it. “Viability,” once a technical safeguard, became an ideological norm: a moral injunction that public interest must never endanger private profit.

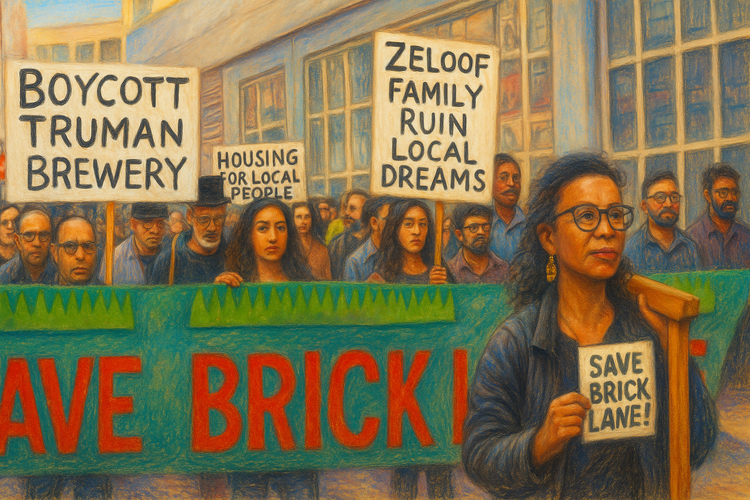

In the Brazilian planner Raquel Rolnik’s account of global housing policy, this marks a new “empire of finance.” What had once been the right to housing has mutated into the right of investors to extract income from land. The Towards a New London Plan consultation translates that principle into metropolitan law, its rhetoric of delivery concealing an institutional alignment between government and capital.

Governance by Yield

Financialisation does not merely alter prices or tenure; it remakes governance itself. Every domain of planning—heritage, brownfield redevelopment, social housing, environmental regulation—is re-coded according to the calculus of yield.

Social housing becomes residual, displaced by “affordable rent” products pegged to market levels. Brownfield regeneration serves as an alibi for speculative redevelopment of historic and working-class districts. Conservation is reframed as retrofit efficiency, the city’s memory valued only as a carbon offset. Public land becomes collateral for municipal debt issuance.

Through this convergence, London’s planning system functions less as a guardian of collective life than as a transfer mechanism, shifting value from public ownership to private portfolios.

The New Orthodoxy

Viewed through this lens, the 2025 Plan’s housing target is not a social imperative but a throughput requirement: each dwelling a revenue stream, each policy a device for risk management. The obsession with viability testing mirrors the securitised mortgage logic identified by Aalbers—an endless cycle of valuation, packaging and trade. The city becomes what Harvey once described as “a vast building site for capitalist surplus absorption.” “Streamlining” means the removal of friction: the heritage checks, affordability quotas and local consultations that once tethered development to civic purpose. Governance now serves what Christophers terms asset-manager capitalism—a regime in which global funds own and operate the spaces of everyday life in search of stable rent yields.

Toward a Critical Urban Method

To confront such a system requires more than preservationist sentiment or procedural reform. It demands what Harvey and Aalbers alike propose: a critical urban political economy—an analysis that locates planning, housing and heritage within the wider circuits of capital accumulation. The evidence is already visible. The same valuation models that devalue social housing determine which listed buildings are “viable” to retain. The same development finance that raises towers on the South Bank dictates borough regeneration strategy. The same asset-management firms lobbying for “delivery certainty” underwrite the Mayor’s housing quotas.

The financialisation of housing has thus become the financialisation of planning itself. Towards a New London Plan merely codifies this reality into law. London today is a city designed for circulation rather than habitation—a metropolis optimised for capital, not community. To imagine another path is to re-assert, in the historian Lewis Mumford’s terms, “the organic relation between place and purpose”: to reclaim the city as a commonwealth rather than a marketplace.

Index

Aalbers, Manuel B. — Defines the financialisation of housing; explains creation of “liquidity out of spatial fixity”; identifies the real-estate/financial complex.

Asset Manager Capitalism — Term (Christophers) for the dominance of global funds that own and operate everyday urban space.

Asset Urbanism — Planning conceived as the management of property as a financial asset.

Asset State — British state form whose fiscal stability depends on sustaining property values.

Brownfield Regeneration — Redevelopment of industrial or working-class districts used as an alibi for speculative investment.

Building Societies (UK) — 1980s deregulation enabling mortgage securitisation and large-scale asset trading.

Christophers, Brett — Economic geographer; describes London as “a portfolio in itself”; theorist of asset-manager capitalism.

City of London — Global financial hub through which capital penetrated UK property markets.

Council Estates — Converted into investment vehicles through privatisation and “regeneration” schemes.

Deregulation — 1980s–1990s policy shift integrating housing finance with global capital flows.

Financialisation — Transformation of housing, land and planning into circuits of financial accumulation.

Financialisation of Planning — Integration of viability testing and risk management into public policy.

Harvey, David — Geographer; theorised the “secondary circuit of capital” and capitalism’s drive to “annihilate space by time.”

Housing Act (1988) — UK legislation that opened public housing to market finance.

Liquidity — Conversion of fixed assets into tradable financial products; central logic of urban finance.

London Plan (2025) — GLA consultation codifying financialised urbanism as official policy.

Mumford, Lewis — Urban historian; called for restoring “the organic relation between place and purpose.”

Opportunity Areas (GLA) — Spatial instruments for speculative investment; planning as pipeline management.

Planning System (UK) — Recast as a mechanism for capital circulation through viability testing and public-land monetisation.

Property as Finance — The long shift from industrial production to asset-based accumulation.

Rolnik, Raquel — Planner and UN rapporteur; author of Urban Warfare; identifies a global “empire of finance.”

Samuel Stein — Author of Capital City; defines the “real-estate state.”

Securitisation — Bundling of mortgages into tradable securities to generate liquidity.

Social Housing — Residualised and redefined as “affordable rent” within a market framework.

Thomas Wainwright — Economic geographer; mapped the transfer of U.S. mortgage logic to U.K. markets.

Towards a New London Plan — 2025 consultation reframing planning as a financial delivery system.

Viability Testing — Mechanism through which profitability becomes the measure of public policy.

In the next article, “The Financialisation of London,” we turn from theory to terrain—tracing how liquidity is mapped into London’s land, its estates, and its communities.