A Tax Without a Vision: Housing, Heritage, and the Perils of Market Rule

The UK government is preparing what may be the most radical overhaul of property taxation in decades. From new levies on landlords’ rental income to proposals for restructuring inheritance tax, ministers insist that “no stone will be left unturned.” The ambition is dressed in fairness: to make housing more accessible, to bring landlords into line, and to dampen speculative excess.

Estate agents warn of a market slowdown. Landlords mutter about squeezed returns. First-time buyers dare to hope, though their hopes have been dashed before. Tenants meanwhile continue to spend an unaffordable 36 percent of their income on rent — a figure that places Britain among the most unaffordable rental markets in Europe.

And yet, beneath the noise, one problem persists: these reforms, however bold they sound, remain superficial. They shuffle the tax code but do not shift the foundations. They treat symptoms without addressing the structural challenges that define Britain’s housing crisis: affordability, speculation, climate breakdown, and the slow wasting away of one of our greatest national resources — the vast stock of Georgian, Victorian, and Edwardian housing that still defines the look and life of towns and cities across the country.

The Cost of Superficial Solutions

Britain is unusual among wealthy nations in the extent to which perfectly sound housing is left to decline or is demolished outright. Georgian terraces with hand-fired brickwork, Victorian seaside villas built for generations, Edwardian cottages with solid timber frames — all are at risk.

Instead of restoration, we get churn: cheap new builds on greenfield sites, often of inferior quality, often overheating in summer and failing in less than 60 years. Each demolition wastes tonnes of embodied carbon; each rebuild consumes yet more resources. From a climate perspective, this is irrational. From a community perspective, it is catastrophic.

To adjust tax codes without addressing this cycle is to rearrange numbers while ignoring the fabric of life.

What First-Time Buyers Really Need

The government insists it wants to help young people onto the ladder. But tax tweaks alone cannot overcome systemic barriers:

- Speculation: Properties bought as assets, left vacant, hoarded for capital appreciation.

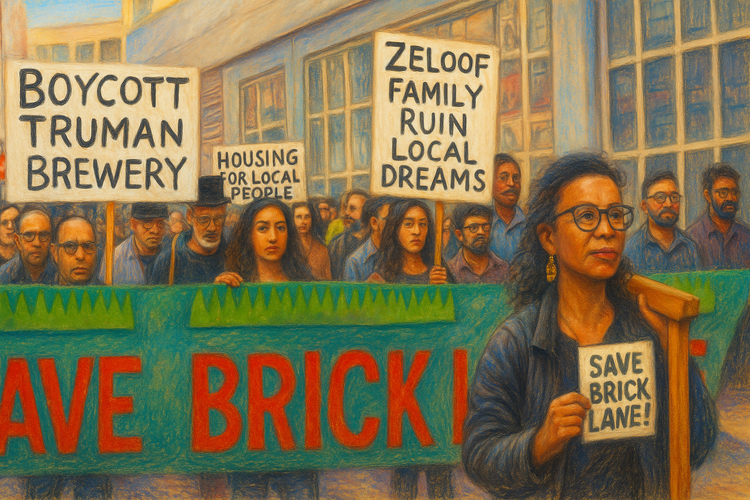

- Short-term lets: Airbnb and similar platforms siphon homes into tourist economies, hollowing out coastal and cultural towns.

- Build quality: Many new flats are cramped, unaffordable, and poorly designed.

What first-time buyers need is not a stamp duty shuffle but homes that are:

- Accessible — priced within reach of local incomes.

- Durable — built or restored to last beyond a generation.

- Sustainable — upgraded with energy efficiency and liveability in mind.

That requires incentives for restoring existing stock, financial penalties for speculative vacancy, and an integrated programme of retrofit and repair.

Britain’s Untapped Resource: Period Housing Stock

The UK possesses one of the world’s largest stocks of Georgian, Victorian, and Edwardian housing. These are not relics. They are living assets:

- Craftsmanship: Seasoned timber, slate roofs, lime plaster — all designed to breathe, flex, and endure.

- Adaptability: Terraces can be extended, divided, or re-joined across generations.

- Embodied Carbon: Demolishing them discards centuries of stored energy and releases vast emissions.

The Victorian Society and SAVE Britain’s Heritage have long sounded the alarm. Each time a row of Victorian terraces is cleared, we lose not just buildings but cultural memory, environmental capital, and the chance to house families in durable homes.

Communities, Not Commodities

Here lies the deeper danger: treating housing as a market first and a community last.

As Jane Jacobs wrote in The Death and Life of Great American Cities:

“Cities have the capability of providing something for everybody, only because, and only when, they are created by everybody.”

Yet Britain’s housing policy often favours the opposite — large-scale clearances, speculative investment, absentee ownership. Jacobs warned of “cataclysmic money”: big projects and financial flows that obliterate neighbourhood texture in pursuit of abstract efficiency.

Lewis Mumford, writing in The Culture of Cities, put it starkly:

“The great city is the best organ of memory man has yet created.”

To lose our historic housing is to lose our organ of memory — the accumulated layers of craft and continuity that anchor communities.

George Monbiot is more blunt:

“The market has no morality. It has no sense of the past or the future. Left unchecked, it will consume the very fabric of our lives.”

Housing is where this plays out most dangerously: when left to markets alone, we get vacancy, speculation, and churn, rather than continuity, affordability, and care.

And Catherine Bauer Wurster, one of America’s pioneering housing reformers, insisted in 1934:

“The test of a housing policy is not the number of units built but the lives that are lived in them.”

By that measure, Britain is failing.

The Skills Gap: Losing a Living Tradition

Every building is also a record of skills. If the Georgian, Victorian, and Edwardian stock is left to decline, we don’t just lose homes. We lose the crafts that sustained them.

- Lime mortar pointing and plastering — essential for breathable walls — is now practiced by only a handful.

- Sash window repair has been replaced by mass PVC replacement, undermining both performance and heritage.

- Roofing in slate and clay tile is threatened by the dominance of imports and synthetic substitutes.

Without demand, skills wither. Without skills, repair becomes expensive. And as repairs grow rarer, more homes are demolished — accelerating the loss.

This is not just about buildings. It is about livelihoods, trades, and identity. To let the stock rot is to let the skills die. To invest in repair is to invest in jobs and continuity.

Managed Decline vs. Living Continuity

Current policy often privileges “new units built” over “homes restored.” Local authorities are judged by housing numbers, not by quality or permanence. The result is predictable: demolition is easier to justify than careful repair.

This creates:

- Loss of embodied carbon.

- Loss of cultural identity — generic new blocks where historic streets once stood.

- Loss of skills — as trades die out with disuse.

It is easier to destroy than to restore. But easier does not mean wiser.

What Joined-Up Thinking Could Look Like

The UK already has tools. They remain scattered, underfunded, and poorly integrated. Consider:

- Heritage Lottery Fund: finances façade repair, conservation, and skills training.

- Historic England: provides grants for urgent works and townscape heritage schemes.

- Town Deals: Margate’s £22.2m package includes heritage-led renewal.

- Empty Homes Initiatives: in Kent, loans help owners restore derelict stock.

- Community Housing Fund: enables local groups to acquire homes for restoration and shared stewardship.

What’s missing is a national vision that connects tax policy to these tools. A coherent system would:

- Zero-rate VAT for repair and retrofit (currently 20%, while new build is perversely tax-free).

- Tie vacancy penalties to local restoration funds.

- Expand heritage apprenticeships nationwide.

- Support community trusts in acquiring long-term vacant homes.

Restoration Case Studies: Lessons from Margate

- Dalby Square: Once notorious for decline, restored with Lottery funding, including a Victorian villa upgraded to passivhaus standard — a model of heritage + sustainability.

- Cliff Terrace: Its crumbling colonnade saved by community campaigns and grant aid, now housing independent shops.

- Sweyn Road: Derelict guesthouses purchased and converted back to family homes under the Live Margate scheme.

- Edgar Road: A derelict block being converted into ten council flats — adaptive reuse chosen over demolition.

These show what is possible when policy, funding, and community align.

A Restoration Deal for Britain

To avoid tinkering, Britain needs a “Restoration Deal” that combines:

- Fiscal Reform

- Zero VAT on repairs.

- Tax relief for sustainable retrofits.

- Penalties for speculative vacancy.

- Environmental Imperatives

- Prioritise retrofit over demolition.

- Invest in low-carbon traditional materials.

- Align housing with net-zero.

- Skills and Jobs

- Apprenticeships in historic crafts.

- Grants to firms training in traditional methods.

- Regional centres for heritage skills.

- Community Continuity

- Empower local housing trusts.

- Incentivise long-term letting.

- Protect first-time buyers with affordability schemes tied to restored stock.

Conclusion: Homes, Not Markets

As Mumford said, “The great city is the best organ of memory man has yet created.” To demolish its homes is to amputate its memory.

As Jacobs insisted, communities thrive when they are created by everybody, not by markets alone.

As Monbiot warns, markets cannot protect the past or plan for the future. That is the role of policy, vision, and collective will.

And as Bauer Wurster reminded us, housing must be judged not by numbers but by lives lived.

If Britain wants housing reform that is fair, sustainable, and human, it must look beyond superficial tax tinkering. It must embrace a holistic vision where heritage stock is restored, skills revived, and communities renewed.

Anything less is not reform. It is evasion.